Morning Note: Market News and an update from National Grid

Market News

Gold and stocks have rallied to all-time highs as the US government shut down and surprising weakness showed in private payrolls. The yellow metal currently trades at $3,862 an ounce, after a 10% jump in September and 17% rally in Q3. Goldman said there’s room for gold to rally even higher.

Treasury yields fell across the curve with the short end outperforming – the 10-year yields 4.11%. The dollar fell after an unexpected drop in ADP employment resulted in Fed swaps pricing in deeper rate cuts. The Supreme Court refused to let President Trump immediately oust Fed Governor Lisa Cook while deferring the arguments to January.

US equities rallied last night – S&P 500 (+0.3%); Nasdaq (+0.4%) – boosted by the healthcare sector on optimism stemming from Pfizer’s deal with the White House earlier this week. OpenAI’s valuation has risen to a record $500bn after a share sale, overtaking SpaceX.

In Asia this morning – Nikkei 225 (+0.9%); Hang Seng (+1.9%); Shanghai Composite (+0.5%) – gains were driven by tech shares as Samsung and SK Hynix struck a deal with OpenAI and JPMorgan lifted Alibaba’s price target.

The FTSE 100 is currently 0.2% higher at 9,462, with Tesco up 2% after the food retailer lifted its full-year profit forecast. The FT reports the UK is set to exempt investors from the 0.5% tax on buying shares of newly-listed companies on the LSE and Chancellor Reeves is set to remove higher business rates for UK retailers. Sterling trades at $1.3495 and €1.1485.

Brent Crude trades at $65.35 a barrel, close to a four-month low, weighed down by expectations of higher OPEC+ supply amid broader uncertainties. GM, Hyundai, and Ford said they’ll extend EV discounts after a US tax credit expired to maintain sales momentum.

Source: Bloomberg

Company News

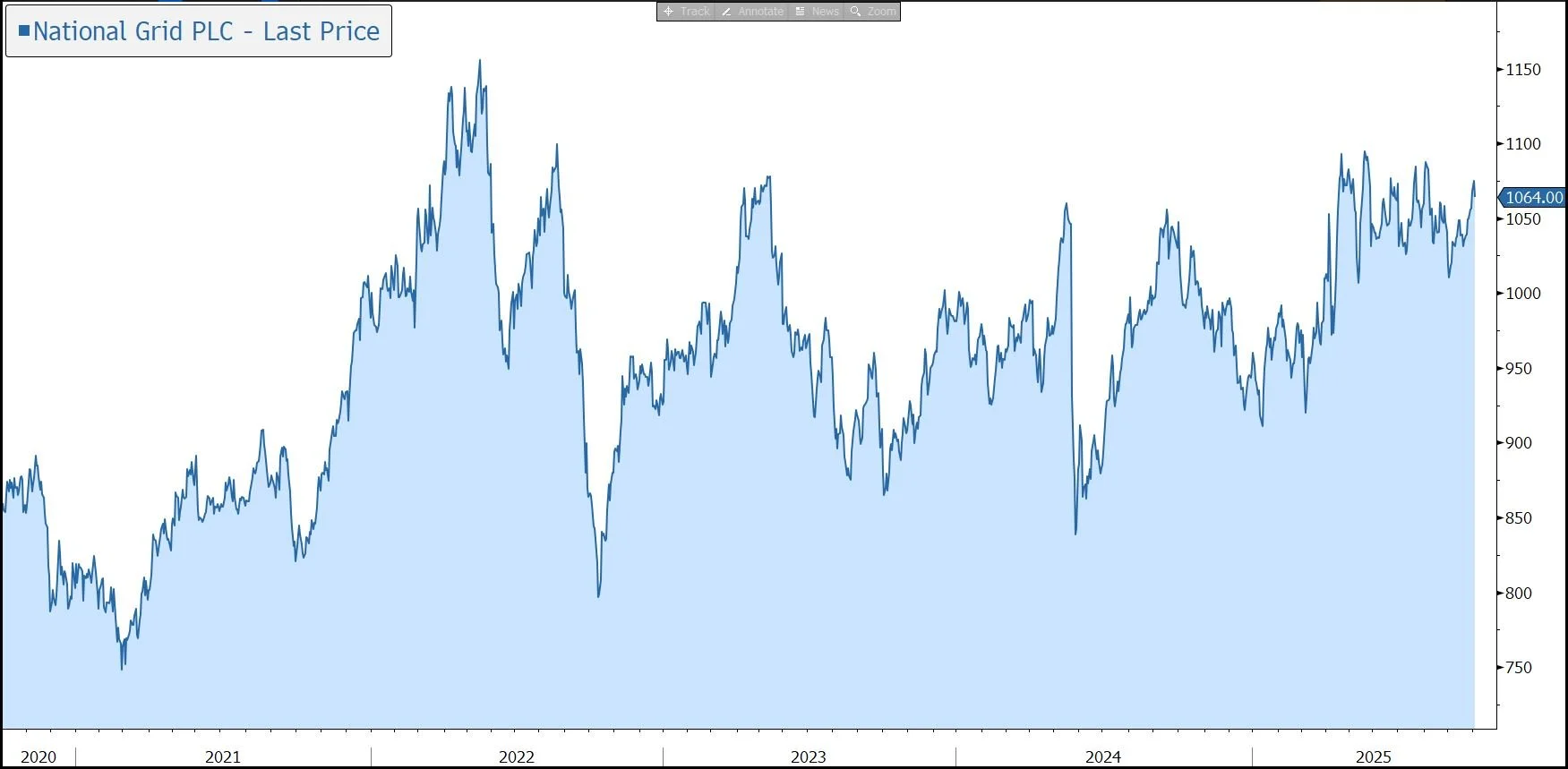

National Grid has today released a brief pre-close update for the six months ended 30 September 2025 ahead of announcing half year results on 6 November. The statement highlights the group's overall performance is in line with management expectations. We are positive on the long-term outlook for the business given the company’s critical role in the energy transition and security of supply. As an income stock, the performance of the shares is driven, in part, by bond yields, with the recent volatility providing some uncertainly. In response to today’s robust update, the stock is down 1% in early trading.

National Grid operates a regulated business in the UK and US, with electricity and gas transmission and distribution assets. The group has no direct exposure to volatile commodity prices and relatively little exposure to usage levels.

Over the last couple of years, the group has undertaken several transactions to pivot its portfolio towards electricity. This has enhanced the group’s role in the decarbonisation of the energy system, with investment in infrastructure that enables higher penetration of renewable energy and low carbon technology. Increased demand will also come from new connection to AI datacentres. The company plays a critical role in ensuring affordability and security of supply, an issue that clearly came to the fore following the power outage in Iberia earlier in the year.

The company is undertaking a significant step up in investment, around £60bn over the five years to March 2029, nearly double the prior five years. This is expected to deliver a step-change in critical energy infrastructure in the UK and US in support of energy transition, security of supply, and economic growth objectives. The target is to generate asset growth CAGR of around 10%, with group assets heading towards £100bn by 2029, and underlying EPS CAGR of 6%-8% (vs. a base of 73.3p in FY2025).

Of the £60bn investment, around £51bn will be aligned to the EU Taxonomy to decarbonise energy networks. Nearly 80% will go into the group’s electricity networks, moving the mix towards 80%/20% electricity/gas by 2029. The company will further streamline its portfolio to focus on pure-play networks across regulated and competitive, onshore and offshore networks. It has already sold its ESO (electricity system operator, £673m), the final 20% equity interest in National Gas Transmission (£686m), agreed the sale of its National Grid Renewables onshore business in the US and Grain LNG (£1.66bn, including a pre-completion dividend).

Regulatory progress has continued. In July, UK regulator Ofgem published its RIIO-ET3 draft determination which covers the National Grid Electricity Transmission business for the period April 2026 to March 2031. In its response, while welcoming the commitment to an £80bn investment plan for the electricity transmission sector and the recognition of the need for urgent delivery, National Grid believes the Draft Determination doesn't fully account for the practical challenges of significantly expanding the electricity system. The company believes changes regarding the baseline return, incentives, and funding mechanisms are necessary to meet business plan commitments, accelerate decarbonisation, and achieve cost savings for consumers. The company will continue to engage with the regulator ahead of the Final Determination in December.

Back in May, the company announced that Zoë Yujnovich would become the next CEO with effect from 17 November 2025, succeeding John Pettigrew, who after almost ten years in role, will retire from National Grid on 16 November 2025.

In today’s update, the company highlights that performance is in line with management expectations and, as usual, underlying EPS is expected to be weighted to the second half of the year. The profile of half-year operating profit is also expected to be broadly consistent with historical periods.

In UK Electricity Transmission and UK Electricity Distribution, the company anticipates operating profit to be broadly evenly split across the year. We note that the same period last year included the contribution from the Electricity System Operator before it was sold in October 2024.

In the US regulated businesses, operating profits are expected to be weighted to the second half. Relative to the same period last year there have been fewer storms impacting the New York business, as well as new electricity distribution rates in the New England business. As such, the company expects a slightly higher contribution to operating profit from both businesses in the first half relative to the profile last year.

In National Grid Ventures, the company expects a roughly even weighting of profitability across the year.

As a reminder, National Grid has a robust balance sheet and a strong investment grade credit rating, underpinned by regulatory revenue, which allows the group to secure the required long-term funding needed to invest in its business. The group believes it has the financial flexibility to deliver its strategy over the 5-year financial framework, helped in part by the £6.8bn rights issue in May 2024.

The stock remains popular for investors seeking an attractive income that is growing in real terms – the dividend policy is to deliver annual growth in line with the increase in average UK CPIH inflation. The payout for the last financial year was increased by 3% to 46.72p, equivalent to a yield of 4.4%.

Source: Bloomberg