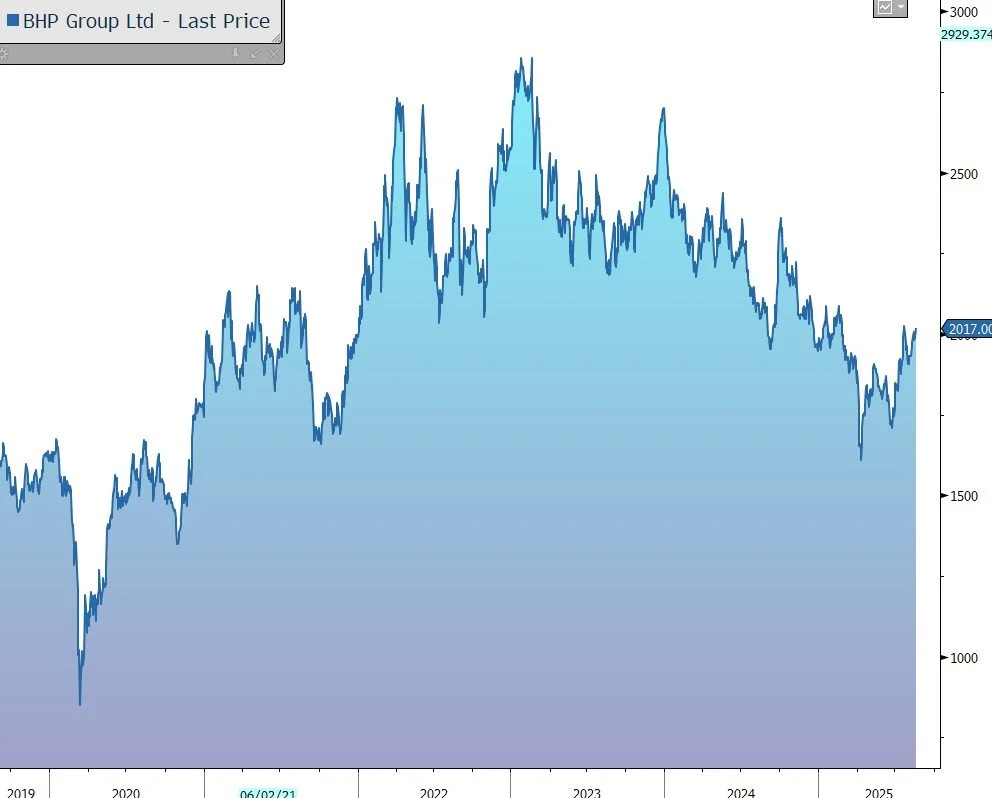

Morning Note: Market news and an update from miner BHP Group.

Market News

Donald Trump’s meeting with Ukraine’s president and European leaders ended with a call for a summit with Russia.

President Zelenskiy said he was encouraged that the US would participate in security guarantees as part of any peace deal and signalled that Trump had agreed to a key ask: that discussion of territorial exchanges be reserved for direct talks with Putin.

The US’s AA+ rating was affirmed with a stable outlook by S&P, which noted tariff revenue will help offset the fiscal impact of recent spending legislation. 10-year Treasury yields were up slightly to 4.34%. Gold held steady at $3,340 an ounce as UBS raised its forecast, expecting prices to hit $3,700 by the end of June 2026. Brent Crude trades at $66 a barrel.

US equities were little changed last night in lacklustre trading. Intel rose post-market after SoftBank agreed to invest $2bn, while the US is said to be weighing a 10% stake that may convert $10.9bn in Chips Act grants into equity.

In Asia this morning, equities drifted lower: Nikkei 225 (-0.4%); Hang Seng (-0.2%); Shanghai Composite (flat). Japanese government bond futures extended losses after sale of a 20-year government debt drew weak demand. In China, households are turning to domestic equities for better returns as interest rates fall.

The FTSE 100 is currently little changed at 9,165, while Sterling trades at $1.3520 and €1.1575. Gilt yields continue to drift higher – the 10-year is now 4.76%. The UK Treasury is considering replacing stamp duty with a new tax on home sales above £500,000, the Guardian reported.

Source: Bloomberg

Company News

BHP Group has released results for the financial year to 30 June 2025 which were slightly below market expectations. The company generated record production, continued sector-leading margins, and paid out 60% of profits as dividends. In order to fund its organic growth projects, the company has raised its net debt target range. In response to today’s update, the shares are up 2% in early trading.

BHP is a diversified resources company with exposure to iron ore, metallurgical coal, copper, nickel, and potash. Assets are high quality and largely located in lower-risk jurisdictions, with strong development potential. The group’s capital allocation framework provides flexibility at the bottom of the cycle and discipline at the top, and has seen a shift in focus to low-cost, high-return projects. BHP has positioned itself to benefit from the unfolding mega-trends of decarbonisation, electrification, population growth, and the drive for higher living standards in the developing world, which it sees becoming key drivers of commodity demand.

BHP’s external operating environment in FY2025 was shaped by complex and evolving global developments. Policy uncertainty, particularly around tariffs, fiscal policy, monetary easing, and industrial policy, has been elevated and continues to influence investment and trade flows. Despite these dynamics, commodity demand remained resilient.

During the latest financial year, underlying attributable profit rose by 26% to $10.16bn, a touch below the market forecast of $10.22bn. The result was driven by strong underlying operational and cost performance.

BHP delivered record volumes at Western Australia Iron Ore (WAIO) of 257 Mt driven by recent investment in the WAIO supply chain and record production at the Central Pilbara hub. The company maintained its position as the world’s lowest cost iron ore producer, however profit fell 24% primarily driven by lower average realised prices for iron ore, which decreased 19%.

Copper production exceeded 2 Mt for the first time, up 28% over the past three years, including a 16% production increase at Escondida. Higher realised copper prices had a favourable impact of $1.0bn on profitability.

Coal profitability fell by 75% to $0.6bn driven by lower production – steelmaking coal (-19%), energy coal (-2%) – and low realised price – steelmaking coal (-27%), energy coal (-11%).

During the year, the group experienced an effective inflation rate of 3.1% across its markets. Overall inflationary pressures across the group’s cost base have largely normalised, although pockets of pressure persist in some areas, and overall cost levels remain materially higher than pre-pandemic benchmarks.

Productivity initiatives and cost discipline helped to mitigate cost pressures and the company generated a 53% EBITDA margin, maintaining the 20-year average above 50%.

Capital and exploration expenditure grew by 6% to $9.8bn as the group increased its exposure to future-facing commodities of potash and copper. The company has a pipeline of copper projects under development in Chile and Australia, while the Jansen potash project in Canada is expected to deliver first production by mid-2027. In each of the next two years, BHP expects to spend $11bn in capital and exploration, reducing to $10bn on average each year between FY2028 and FY2030. 70% of medium-term capital spend is expected to be focused on future-facing commodities.

During the year, free cash flow fell by 55% to $5.3bn and net debt rose from $9.1bn to $12.9bn (still only 19.8% gearing). As expected, borrowing came in at the top end of the target range of $5bn-$15bn, and the company has now raised its range to $10bn-$20bn as it invests in high-quality organic growth projects.

BHP’s dividend policy provides for a minimum 50% payout of underlying attributable profit at every reporting period. For FY2025, the group continued its track record of delivering robust shareholder returns through the cycle – dividend of $1.10 per share has been declared (or $5.6bn), equal to a yield of % and a payout ratio of 60%.

Looking forward, the company highlights that the global economic outlook is mixed, although demand for commodities remains strong, particularly in China and India. Chinese copper demand outperformed in FY25, while iron ore demand was resilient, driven by strong infrastructure investment and manufacturing activity in China. Steelmaking coal prices have softened due to oversupply, though policy shifts in China and new blast furnace capacity in Asia are expected to support the market. Potash markets are expected to continue to benefit from a growing and wealthier population and the need for more sustainable agriculture. The company remains confident in the long-term fundamentals of steelmaking materials, copper, and fertilisers, which are critical to global growth, urbanisation and the energy transition.

Source: Bloomberg