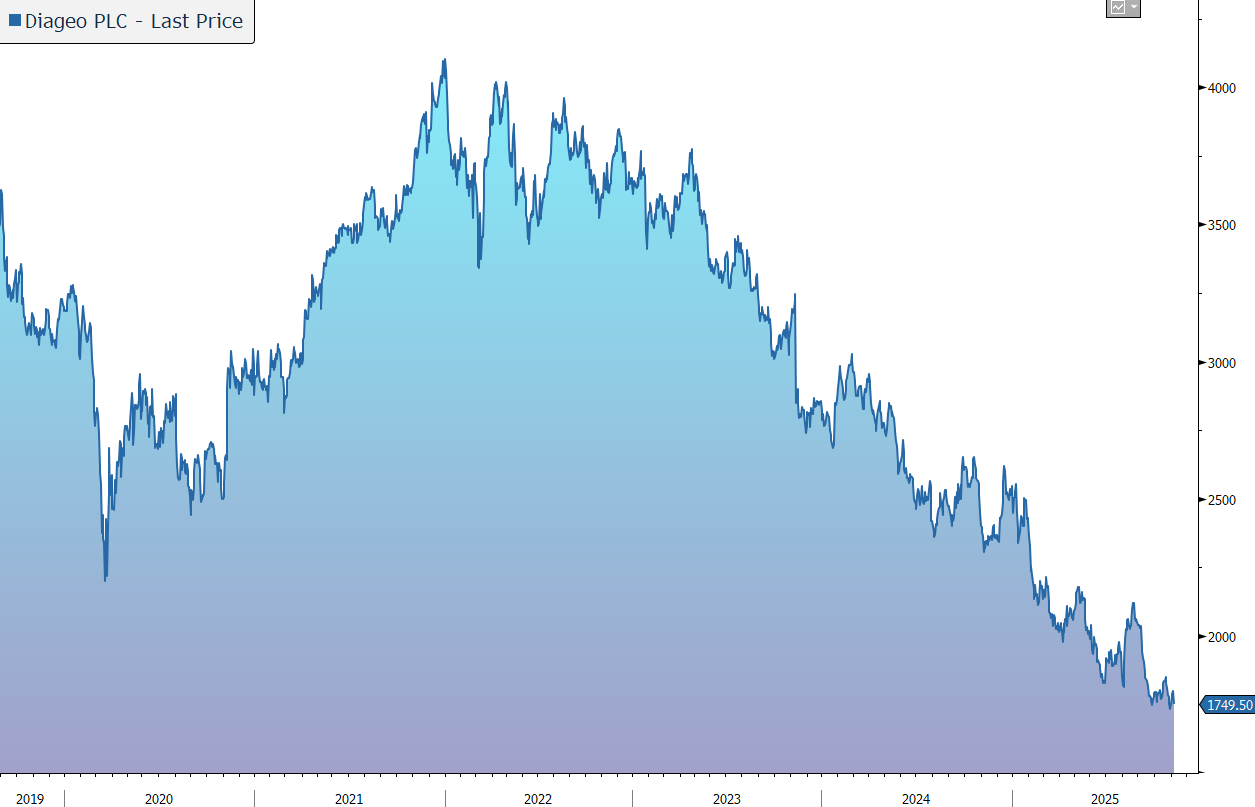

Morning Note: Market news and an update from drinks company Diageo.

Market News

The US Supreme Court appeared skeptical of Donald Trump’s tariffs, with some justices suggesting he had overstepped his authority. Even if they are struck down, the president has other legal avenues to pursue, leaving companies and countries in limbo. Bloomberg Intelligence sees a 60% chance that reciprocal and fentanyl levies will be ruled unlawful. Gold moved back above $4,000 an ounce.

US equities rose last night: S&P 500 (+0.4%); Nasdaq (+0.7%). Alphabet, the owner of Google, was firm on news that Apple is said to be nearing a deal to pay Google about $1bn a year for an AI model to power a revamped Siri. Google is also in early discussions to deepen its investment in Anthropic, Business Insider reported. The positive momentum continued in Asia this morning: Nikkei 225 (+1.3%); Hang Seng (+2.1%); Shanghai Composite (+1.0%).

The FTSE 100 is currently little changed at 9,772. Stocks trading ex-dividend today include HSBC (0.71%) and Unilever (0.85%). The Bank of England is expected to hold rates at 4% today, but economists say it will be a tight decision with a 6-3 split the most common response in a survey. Sterling trades at $1.307 and €1.1355.

The 10-year Treasury yields 4.14%. Global bond sales have soared to a record $5.94 trillion in 2025 as borrowers rush to fund everything from AI to a revival in M&A. With more than a month left in the year, Wall Street is bracing for the busiest November in over a decade.

Source: Bloomberg

Company News

Diageo has released a trading statement for the three months to 30 September 2025, the first quarter of its financial year to 30 June 2026. As a result of weakness in Chinese white spirits and a softer US consumer environment, the company has trimmed its guidance for the full year. Organic sales are now expected to be ‘flat to slightly down’ versus ‘similar to FY2025’. Organic operating profit growth is now expected to be ‘low to mid-single digit’ versus ‘mid-single-digit’ previously. The company has, however, reiterated its free cash flow and financial gearing targets. Ahead of the analysts’ call later this morning, the shares have been marked down by 2%.

Diageo is a leading global drinks company, with a unique portfolio of iconic brands including Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, and Guinness. The company owns 13 billion-dollar brands across a broad range of categories that are gaining share from beer and wine. The group is an integrated operator, producing and supplying drinks at a variety of price points across strong global distribution routes. In the long term, we believe Diageo is well placed to benefit from the trend towards premiumisation – including its 34% stake in Moet Hennessey, the group generates more than 60% of its sales from high margin, premium brands. The group has a strong presence in under-penetrated emerging markets, where the number of people of legal purchasing age is set to increase by over 600m by 2030. Wealth is also increasing in these regions, with the middle class expanding, and consumers shifting from local products to higher-margin premium international brands.

However, the global industry environment has been challenging of late. In addition to a rebasing of consumer spending in the aftermath of the pandemic spending boom, the sector faces potential headwinds from the impact of weight-loss drugs on alcohol consumption and the request by the US Surgeon General for alcoholic drinks to carry warnings of their links to cancer. Other structural threats include Gen-Z moderation and cannabis cannibalisation. Further political risk comes from the proposed tariffs by the new Trump administration.

Current research suggests these factors will have less of an impact than currently feared. For example, during the summer, investment bank Jefferies commissioned a survey of 3,600 US consumers to better understand their attitudes towards alcohol, finding that although moderation was becoming increasingly important, money was the biggest impediment rather than health concerns. This implies that the biggest consumption headwind is cyclical, not structural, and that a positive macroeconomic turn is likely to be an inflection point for the industry. In addition, the industry has increased its lobbying to counter the message coming from health bodies.

In the medium term, we expect the structural tailwinds highlighted above to more than offset the headwinds, leading to positive industry growth. In addition, Diageo is focused on strengthening the resilience of its business through operational excellence, productivity, the introduction of innovative new products, and strategic investments to win market share.

In July, the company announced that its CEO has stood down with immediate effect, by mutual agreement. Until a permanent appointment is made, the CFO has assumed the role of CEO on an interim basis.

The first phase of the company’s Accelerate programme is progressing well and involves cash delivery targets and a disciplined approach to operational excellence and cost efficiency. These include:

- to sustainably deliver around $3bn free cash flow p.a. from this financial year (FY2026), increasing as the business performance improves.

- cost savings of $625m over the next three years, with 50% of the benefit expected to drop through to operating profit and the remainder reinvested in future growth.

- deleveraging the balance sheet to be well within the target range of 2.5x-3.0x net debt/EBITDA no later than FY2028. This will be delivered through a combination of organic growth and positive operating leverage, combined with tighter capital discipline, and appropriate and selective disposals over the coming years.

- opportunities for ‘substantial changes’ to the portfolio by offloading assets that are not ‘core or strategic’. In particular, they are looking at capital intensive businesses that don’t add synergy to the group that can be sold for an attractive price, with the company highlighting today that plans are progressing well.

This morning the company has said that early results from initiatives to strengthen its commercial execution capabilities, notably in Europe, are encouraging.

However, current trading remains subdued. In the three months to 30 September 2025, reported net sales fell by 2.2% to $4,875m, largely reflecting the negative impact of disposals and with negligible impact from foreign exchange. Organic net sales (which excludes M&A and currency impact) were flat. Organic volume growth of 2.9% was offset by negative price/mix of 2.8%.

Overall, from a category perspective, there was good growth in scotch, notably Johnnie Walker and in beer with Guinness. There was also strong momentum in Ready to Drink products, particularly Smirnoff Ice and branded cocktails, offsetting weakness in Chinese white spirits and tequila in North America.

Organic net sales growth in Europe (+3.5%), Latin America & Caribbean (+10.9%), and Africa (+8.9%) was offset by weakness in Chinese white spirits (CWS) impacting Asia Pacific results (-7.5%) and softer performance in North America (-2.7%) as US Spirits declined reflecting weak consumer confidence. The company estimates that weakness in CWS in China negatively impacted group net sales by c.2.5% in the quarter.

As expected, this update only covers sales so there is less detail on profitability or the group’s financial position. The company did highlight that its Accelerate programme to create a more agile operating model is progressing well, with cost savings guidance of c.$625m over the next three years fully on track.

As a reminder, the company earns an attractive operating margin in the high-20s, while at the last balance sheet date (30/06/2025), financial gearing was 3.4x net debt to EBITDA. The company remains committed to returning to its target range of 2.5x-3.0x ‘no later than’ FY2028 and by then gearing will be in the middle of the range. The full-year dividend was maintained at 103.48c, a yield of 4.4%.

Diageo has a long-term track record of coping with tariffs. The company has continued to undertake considerable contingency planning in recent months and is focused on what it can control in relation to tariffs. The company’s guidance for the expected impact of tariffs into the US from UK and European imports remains unchanged at c.$200m pre mitigation on an annualised basis. This assumes that the current tariffs remain at 10% on imports from the UK and 15% on imports from Europe, and that Mexican and Canadian spirits imports remain exempt under USMCA, with no other changes to tariffs. Given the actions to date and before any pricing, Diageo expects to be able to mitigate around half of this impact on operating profit on an ongoing basis.

Due to the adverse impact from Chinese white spirits and a weaker US consumer environment than planned for, the company has trimmed its guidance for the financial year to June 2026 (FY2026). Organic sales are now expected to be ‘flat to slightly down’ versus ‘similar to FY2025’. Organic operating profit growth is now expected to be ‘low to mid-single digit’ versus ‘mid-single-digits’ previously. The company has, however, reiterated its free cash flow (c.$3bn) and financial gearing targets.

Source: Bloomberg