Morning Note: Market news and an update from Danone.

Market News

Gold has fallen to $3,900 an ounce, extending losses from previous sessions to hit a three-week low, as prospects of a US-China trade deal reduced demand for the safe-haven metal. Officials from both countries announced that they had reached a framework agreement on tariffs and other key issues during weekend talks in Malaysia, paving the way for President Trump and President Xi to finalise the deal when they meet later this week in South Korea.

EU and Chinese officials are to hold talks this week in bid to address disputes over rare earths and Nexperia that pose twin threats to auto manufacturers. China’s rare earths export curbs have fuelled alarm in Europe, prompting EU to announce new ReSourceEU scheme with aim of reducing dependence on China for critical minerals, involving supply partnerships with other countries, joint purchasing and stockpiling.

The dollar fell as the Fed is widely expected to cut interest rates by 25 basis points tomorrow, with markets watching for hints of another move in December. The 10-year Treasury yield moved below 4%.

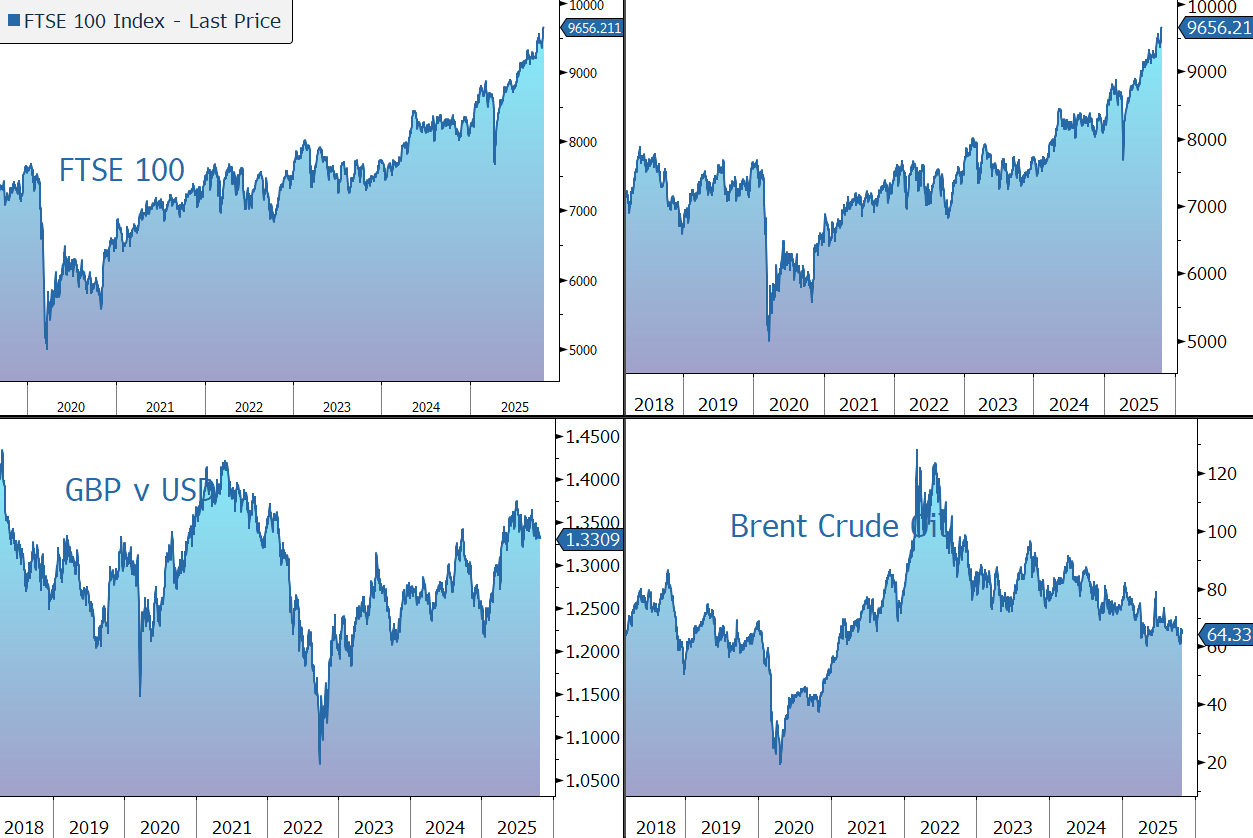

Brent Crude slipped towards $65 a barrel, marking a third straight session of losses, as traders grew increasingly concerned about a supply glut following signals from OPEC+ that it may raise production again.

US equities continued to power ahead last night – S&P 500 (+1.2%); Nasdaq (+1.9%) – with big tech broadly stronger with Tesla and Alphabet the standouts. However, in Asia this morning, markets paused for breath: Nikkei 225 (-0.6%); Hang Seng (-0.5%); Shanghai Composite (-0.2%).

The FTSE 100 is currently 0.2% higher at 9,666, Sterling trades at $1.3335 and €1.1440. HSBC is trading 3% higher as it raised its profitability outlook for this year.

Source: Bloomberg

Company News

Danone has released a Q3 sales update which was better than market expectations, driven by volume/mix and a good recovery in Europe. Guidance for 2025 to be in line with the company’s medium-term strategic target has been reiterated. In response to today’s update, the shares are unchanged in early trading.

Danone is a global health and nutrition company which has undergone a shift to a more balanced growth model, with 20 brands with sales of more than €500m. Under its Renew Danone strategy, the company is rolling out value-added innovations to make its portfolio more local, more appealing to younger generations, and better suited to fast-changing consumer trends. The company is also shifting towards strategic distribution channels, such as away-from-home, impulse & on-the-go, pharmacies, hospitals and homecare channels. These now account for more than 50% of sales and are growing 2x-3x faster than mass retail.

For the 2025-2028 period, the company expects like-for-like (LFL) net sales growth of 3%-5% and recurring operating income to grow faster than net sales. This financial guidance should allow Danone to deliver a structurally double-digit ROIC and progress towards its long-term ambition of delivering €3bn free-cash-flow.

In Q3 2025, sales rose by 0.7% to €6.9bn, driven by the positive impact of M&A (+0.7%) offset by currency headwinds (-5.1%). In LFL terms (which strips out the impact of currency and disposals) sales grew by 4.8%, versus company guidance of 3%-5% and the market expectation of 4.3%. Growth was made up of 3.2% volume/mix and a 1.6% increase in price. This compares to LFL growth of 4.2% in the first half and leaves the year-to-date growth rate at 4.4%.

Europe (+2.6%) enjoyed a continued step-up, driven by volume/mix which has now been positive for eight consecutive quarters. The stand-out performer was China, North Asia, & Oceania (+13.8%), with strong momentum in all categories. Elsewhere the results were: Asia, Middle East, and Africa (+6.8%), Latin America (+4.3%), and North America (+1.5%).

· In Essential Dairy and Plant-Based Products, the group controls a quarter of the worldwide fresh dairy product market, with brands such as Activia and Actamel, and has exposure to non-dairy through Alpro. In Q3, LFL sales grew by 3.5%.

· In Waters, the group is the world’s second largest bottled water company in volume terms, with brands including Evian, Volvic, and Badoit. In the latest quarter, sales grew by 2.3%.

· Specialised Nutrition is divided into Early Life Nutrition, where the group is the world number two with brands including SGM and Cow & Gate, and Advanced Medical Nutrition, where the group is the European leader, with Nutricia and Fortimel. Sales grew by 8.3% in Q3.

As this was only a sales update, there is no comment update on the group’s profitability or financial position. As a reminder, last year the recurring operating margin was 13.0% and free cash flow was €3.0bn. The group has a robust balance sheet, with net debt ending the year at €8.6bn (1.9x net debt to EBITDA). The company’s return on invested capital hit 10.0% and a dividend of €2.15 was declared, amounting to a yield of 2.7%.

For 2025, the group still expects to perform in line with its mid-term targets: like-for-like sales growth between 3% and +5% with recurring operating income growing faster than sales.

Source: Bloomberg