Morning Note: Market news and an update from Constellation Brands.

Market News

The Dollar index was up 0.6%, extending Monday’s strength. Neel Kashkari warned that drastic rate cuts risk stoking inflation, while Stephen Miran played down the tension between the bank’s job and inflation mandates. The minutes from the Fed’s September meeting are due to be released this evening.

Gold surpassed $4,000 per ounce this morning, reaching a fresh milestone as investors fled to safety amid global economic uncertainties. The US government shutdown, now in its second week, has delayed key economic data, complicating assessments of the country’s economic health. Donald Trump opened the door to blocking back pay for certain federal workers when the government reopens

The Japanese yen weakened past 152 per dollar on, down over 3% so far this week and hitting its lowest level since February, as softer-than-expected wage data dampened prospects for Bank of Japan rate hikes. Japan’s real wages fell 1.4% in August, marking the eighth straight monthly decline as inflation continued to outpace pay growth.

Global equities saw some profit taking last night in the US – S&P 500 (-0.4%); Nasdaq (-0.7%) – and this morning in Asia – Nikkei 225 (-0.4%); Hang Seng (-0.7%).

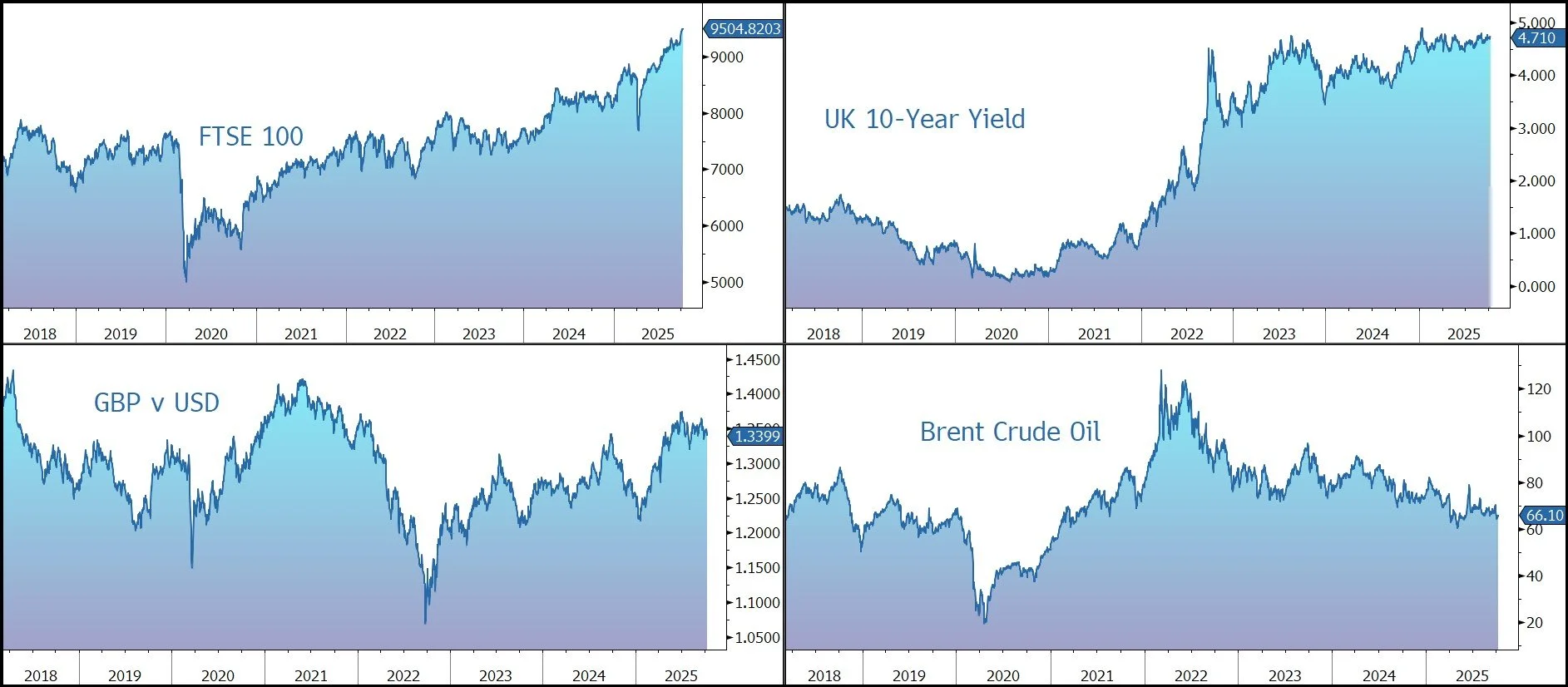

The FTSE 100 is currently 0.2% higher at 9,505, while Sterling trades at $1.3395 and €1.1535. Following its consultation, the FCA said UK consumers who fell victim to motor finance mis-selling between 2007 and 2024 could be eligible for around £700 in compensation on average, leaving the industry on the hook for an estimated £8.2bn-£9.7bn, lower than feared. Lloyds and Close Brothers are both firm this morning.

Brent Crude rose toward $66 a barrel, extending gains from recent sessions as a more modest OPEC+ output hike continued to support prices. BMW cut its annual financial guidance on weak China sales and tariff-related costs.

Source: Bloomberg

Company News

Earlier in the week Constellation Brands released results for the second quarter of its financial year ending 28 February 2026. This followed last month’s profit warning driven by a decline in sales across its Hispanic consumers that was more pronounced than the general market decline. However, the results were not as bad as feared and the US-listed shares were marked up by 2% following the update.

Constellation Brands is a leading international producer and marketer of beer, wine, and spirits, with a portfolio of higher-end brands including Corona, Modelo, and Robert Mondavi. Part of the group’s strategy is to supplement organic growth with bolt-on acquisitions, and to focus on premium, margin accretive, growth opportunities.

Last month the company released an unscheduled trading update and cut its full year guidance. The downgrade was driven by high-end beer buy rate declines for Hispanic consumers that were more pronounced than general market declines, which has an outsized impact on the company’s beer business compared to the broader beer category.

While the company continues to navigate a challenging socioeconomic environment that has dampened consumer demand, the results for the latest quarter were not as weak as expected. During the three months to 31 August 2025, sales fell by 15% to $2,481m, slightly better than the market expectation of $2,459m. Comparable EPS declined by 16% to $3.63, well above the market expectation of $3.38.

By division, the beer business suffered 7% decline in net sales to $2,345m, held back by an 8.7% decline in shipment volumes, reflecting socioeconomic headwinds affecting consumer demand, along with distributor inventory rebalancing during the quarter. Depletion fell by 2.7%, largely driven by a 4% decline in Modelo Especial and 7% at Corona Extra.

The beer business continued to outperform the industry, outpacing the beverage alcohol category by over one percentage point, and the beer category by nearly two percentage points. The beer operating margin fell by 200 basis points to 40.6%, primarily due to increased COGS (including aluminium tariffs) and marketing investments, partly offset by favourable pricing.

In Wine & Spirits, sales fell 19% in organic terms (ex the SVEDKA divestiture) to $136m, driven by a 7.1% decrease in shipment volumes, mostly driven by ongoing weaker consumer demand and continued retailer inventory destocking across most price segments in the US wholesale market. The unit outpaced the corresponding higher-end wine segment in both dollar sales and volume sales performance. During the latest quarter, depletion growth was 2%.

The operating margin fell by 18.1% to a negative 14.6%, primarily due the impact of the SVEDKA divestiture and the 2025 wine divestitures, along with changes in financial and volume-related distributor contractual obligations.

The overall business is cash generative, with free cash flow of $1.1bn in the year to date and net debt gearing remains around the group’s target of 3.0x. The group returned $298m to shareholders in share repurchases and increased its quarterly dividend by 1% to $1.02.

The company is expanding its beer business in Mexico and expects to spend $3.0bn between FY2025 and FY2028 to support the future growth of the core, high-end Mexican beer portfolio with modular additions at existing facilities and a third brewery site at Veracruz. The company currently anticipates its next modular addition to come online in FY2026 and initial production at the Veracruz site to be in late FY2026 or early FY2027.

Looking to the full year, beer net sales are still expected to fall by between 2% and 4%, while operating income is expected to fall by between 7% and 9%. Wine & spirits guidance is unchanged: sales to fall by 17%-20%, with operating income down 97%-100%. Group organic net sales are expected to decline by 4%-6%, with target comparable EPS of $11.30-$11.60 and free cash flow of $1.3bn-$1.4bn.

Source: Bloomberg