Morning Note: Market news and an update from Ceres Power.

Market News

Gold hit a record $3,870 an ounce, on concern the US government will shut down tomorrow. Donald Trump failed to reach an agreement over spending with top congressional leaders and JD Vance said he believes the government is on track to shut down. US funding is set to expire Tuesday unless Congress passes a short-term spending bill by Wednesday. The Bureau of Labor Statistics said it doesn’t plan to release economic data during a shutdown, essentially confirming what traders feared: that a political stalemate will cloud the health of the US economy by delaying key economic data like Friday’s payrolls. Treasuries also benefitting from a flight to safety – the 10-year currently yields 4.12%.

Trump and Benjamin Netanyahu agreed to a 20-point proposal to end the war in Gaza. The plan must be accepted by Hamas, which would need to agree to substantial concessions. Meanwhile, Trump set a 10% tariff on softwood timber and lumber, and a 25% levy on kitchen cabinets starting 14 October.

US equities rose last night – S&P 500 (+0.3%); Nasdaq (+0.5%) – after August pending home sales handily beat expectations, coming in at 4% compared to a forecast for no growth. In Asia this morning, equities were mixed: Nikkei 225 (-0.3%); Hang Seng (+0.4%); Shanghai Composite (+0.5%). Zijin Gold soared in its Hong Kong debut after it raised $3.2bn in the world’s largest IPO since May.

The FTSE 100 is currently 0.2% lower at 9,284, while Sterling trades at $1.3448 and €1.1456. UK shop price inflation rose to 1.4% in September, its highest in 19 months. Prime Minister Kier Starmer prepares for critical address at the Labour Conference, with much riding on what he says.

Oil saw its sharpest drop in three months as rumours of another round of OPEC+ supply increases circulated. Brent Crude currently trades at $66.70 a barrel.

Source: Bloomberg

Company News

At the end of last week, Ceres Power released its H1 2025 results. Although revenue guidance for the full year was cut, the company said it was in later-stage negotiation regarding a new manufacturing licence agreement which, if successful, would be in addition to this guidance. Ceres also announced a business transformation programme to recognise its transition from an R&D-focused to a commercially-led organisation. The company’s primary focus is currently on securing new licence agreements in the commercial power markets to meet the energy demands of AI-driven data centres.

Ceres is a world-leading developer of clean energy technology: fuel cells for power generation, electrolysis for the creation of green hydrogen, and energy storage. The company designs and manufactures steel-based Solid Oxide Fuel Cells (SOFC) which, in very simplistic terms, produce electricity when fuel passes through the fuel cell, via the process of electrolysis. The key benefit of the Ceres steel-based version is that it is fuel agnostic – it can use hydrogen, biofuels, and mains fed natural gas. Its power generation efficiency, which is around 60% and can even reach 85% with a heat recovery system, is significantly higher than the efficiency of centralised gas-fired power generation units, which are around 40%-50%. The steel-based structure also means they are more affordable, scalable, extremely robust, and able to operate at lower temperatures. The ‘time to power’ is a further benefit given the long wait times for grid connections or delivery of power units such as gas turbines. The technology can be used in both stationary and transport applications.

The technology is truly reversible – it is also able to generate green hydrogen at high efficiencies and low cost. The solid oxide electrolyser cell (SOEC) technology produces hydrogen up to a third more efficiently than incumbent low temperature technologies particularly when thermally integrated with industrial processes such as chemicals and steel production. Ceres believes its delivers an operating efficiency improvement of around 30%, compared to PEM or alkaline systems.

The company highlights that over the past year power and hydrogen markets have experienced opposing trends, with significant changes in both the energy and the political landscapes. There has been a marked increase in near-term demand for fuel cells for power solutions in contrast to challenges in the demand and rate of deployment for hydrogen projects. There is now growing demand for clean power that can be deployed rapidly and the company’s licensees’ first products are targeting this power market which is being driven by increased demand from AI data centres and electrification. The hydrogen market continues to be a significant opportunity for both Ceres technology and its licensees but management believe this will follow the power market, benefiting from the maturity and scale achieved by the company’s partners.

The group’s asset-lite business model remains focused on multi-year development partnerships with global original equipment manufacturers (OEMs) to jointly develop products using the technology. Ceres receives a license fee for the initial use of the system technology, engineering fees during product development, and royalties upon commercialisation. This strategy allows for broader market reach and generates high margins.

The company currently has SOFC licensing agreements and joint development projects with some of the world’s largest engineering and technology companies, such as Weichai Power in China (also a 20% shareholder in Ceres), Miura in Japan, and Doosan in Korea. These cover multiple uses including residential boiler systems, range extenders, data centres, marine transport, and stationary power back-up.

Most notably, in July, Doosan Fuel Cell commenced mass market production of fuel cell stacks using Ceres’ solid oxide technology. Doosan will manufacture the stacks and fuel cell power systems at its dedicated factory in South Korea with the ability to produce a combined generational capacity of 50MW of electrical power each year. This marks a significant milestone for Ceres, as Doosan is the first of its strategic licensing partners to enter mass production using its technology. Doosan anticipates the sale of its first SOFC products will occur before the end of 2025, targetting growth applications including AI-driven data centre power, energy grid stabilisation, power systems for buildings, and auxiliary power for marine. The royalty revenue streams due to Ceres will follow Doosan’s first commercial sales.

The main negative for the company was decision last February by German engineer Bosch to end its partnership with Ceres. This was part of a revised strategy by Bosch and did not reflect its confidence around Ceres or its technology. The financial impact for 2025 will be limited, in the low single-digit millions of euros. Bosch was a 17.4% shareholder in Ceres, which it intends to divest in an orderly manner. Although the stake has since been reduced to 14.1%, it still provides something of an overhang.

On the SOEC side, the group has entered into a number of deals:

- a partnership with Shell to utilise the technology to deliver high-efficiency, low-cost green hydrogen. In May, the company announced that its first megawatt SOEC demonstrator system, located at Shell’s Technology Centre in Bangalore, India, is now producing an industry-leading electrolyser module efficiency of 37kWh/kg of hydrogen.

- a global long-term manufacturing collaboration and licence agreement with Delta Electronics of Taiwan for fuel cell stack production. This agreement also covers SOFCs. Delta has committed £170m on assets for the large-scale manufacturing of hydrogen energy solutions, including on Ceres’ technology, for AI-driven data centre power, microgrid and other energy infrastructure applications.

- an SOEC systems licence with Thermax, a leading provider of energy and environment solutions based in India. The agreement includes (as yet undisclosed) licence fees and product royalties to be received by Ceres.

- a long-term licence agreement with Denso of Japan for the manufacture of Ceres’ proprietary SOEC for hydrogen applications. The agreement includes ‘significant’ (as yet undisclosed) revenue for Ceres over multiple years.

Overall, in the first half of 2025, revenue fell by 26% to £21.1m. This was in line with management expectations following significant one-off licence revenue as part of the Delta agreement in 2024. Revenue was split between engineering services & licences (69%) and provision of technology hardware (31%).

The gross margin slipped from 80% to 79%. Operating costs decreased by 6% to £35.6m following the cost base rationalisation announced in 2024 and continued financial discipline. However, the operating loss widened from £13.8m to £17.2m as a result of the revenue decline.

Investment in the business fell from £2.8m to £2.1m due to the conclusion of several R&D projects. The company moved from a cash outflow of £13.9m to an inflow of £1.6m, to leave cash and short-term investments at a comfortable £104m as at 30 June 2025.

As a result of the moves by Doosan and Delta, Ceres has now crossed over from being an R&D company to one that is firmly in a commercial production phase. To drive and support this, Ceres is initiating a 12-month business transformation programme that will prepare the company for the next phase of growth. Specifically, by the end of 2026, Ceres will have: restructured and realigned the business to the market opportunity; commercially launched its best in class, dual purpose stack platform serving both power and hydrogen markets; and reduced its operating costs, so that operating expenses are expected to fall by around 20%. On the analysts’ call, the company disclosed the cost of the programme would be around £1m.

Ceres has cut its full-year revenue guidance to £32m, well below the previous expectation to be broadly similar to last year (i.e. £51.9m). The company has said it is in later-stage negotiation regarding a new manufacturing licence agreement but recognises that completion and timing of revenue recognition are uncertain. If successful, any revenue recognised in the current year would be in addition to the above guidance.

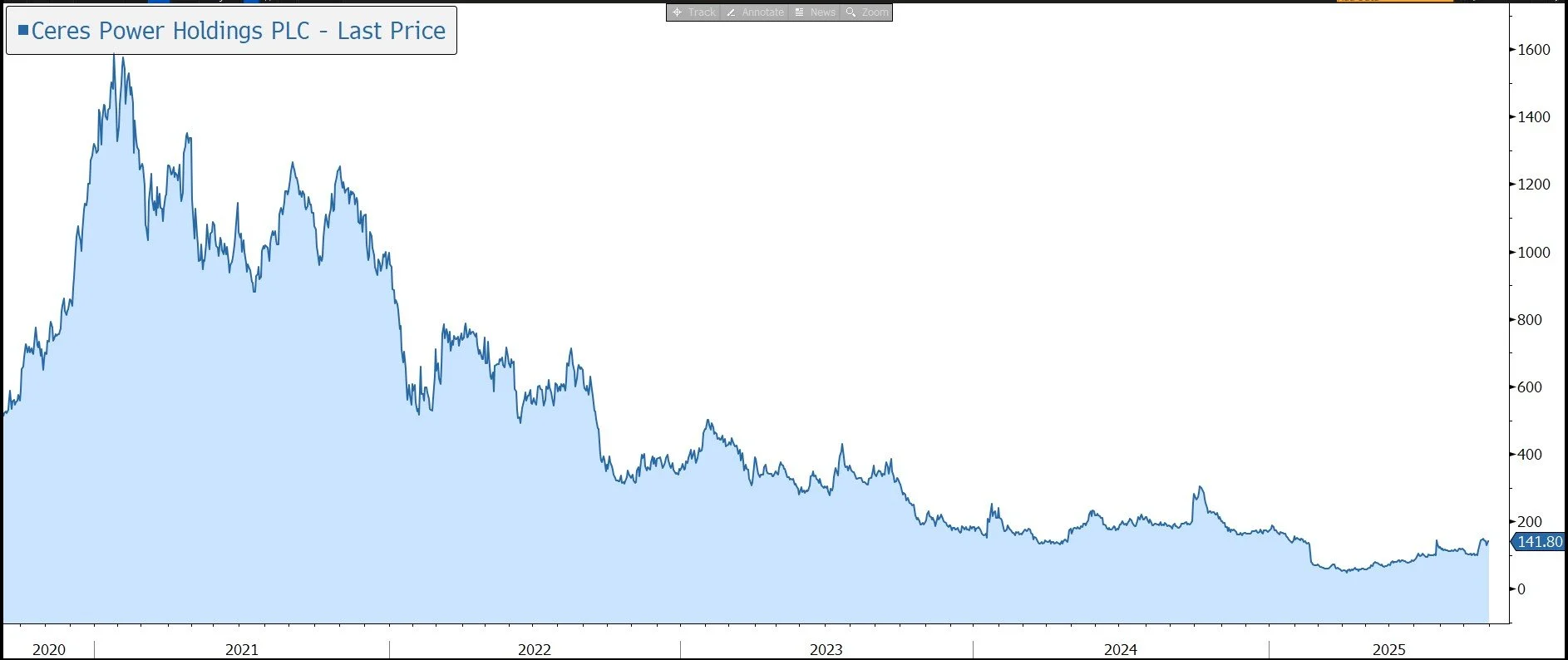

The shares trade on the LSE Main Market. The stock has been very weak over the last three years due, in part, to the impact of rising bond yields on highly-rated unprofitable companies but also due to the failure to complete a 3-way joint venture agreement with Weichai and Bosch, and the subsequent decision by Bosch to terminate its contract with Ceres. The other frustration for investors was the lack of a trading update scheduled for July. However, recent announcements have had a positive impact on the group’s outlook and the share price.

Source: Bloomberg