Morning Note: Market News and an update from Barrick Mining.

Market News

US equities rose last night – S&P 500 (+0.8%); Nasdaq (+1.5%) – driven by optimism over a deal to end the US government shutdown. The Senate passed a temporary funding bill, while the House plans to vote on the measure as soon as tomorrow before it is sent to Donald Trump to sign.

However, the global equity rally stalled in Asia following a report that China is developing a rare earth export system that may complicate access for some American companies: Nikkei 225 (-0.1%); Hang Seng (+0.1%); Shanghai Composite (-0.4%). Japan’s 30-Year bonds fell as fiscal worries weigh on a debt sale.

The FTSE 100 is currently 0.9% higher at 9,881. Sterling moved lower – $1.3120 and €1.1350 – and the 10-year gilt yield fell 5bps to 4.42% following the release of a slew of weak economic data. UK retail sales rose 1.6% last month from a year earlier, the slowest pace since May, according to the BRC, as shoppers held back ahead of the government’s upcoming budget and in anticipation of Black Friday deals. The UK unemployment rose to 5.0%, slightly higher than expected.

Gold continued to add to its recent recovery and currently trades at $4,135 an ounce. JPMorgan Private Bank said central banks’ buying in emerging markets will drive the price above $5,000 an ounce next year. The 10-year Treasury yields 4.12%, while Brent Crude trades at $63.80 a barrel

The European Commission is exploring ways to compel EU member states to phase out China’s Huawei and ZTE from their mobile networks.

Source: Bloomberg

Company News

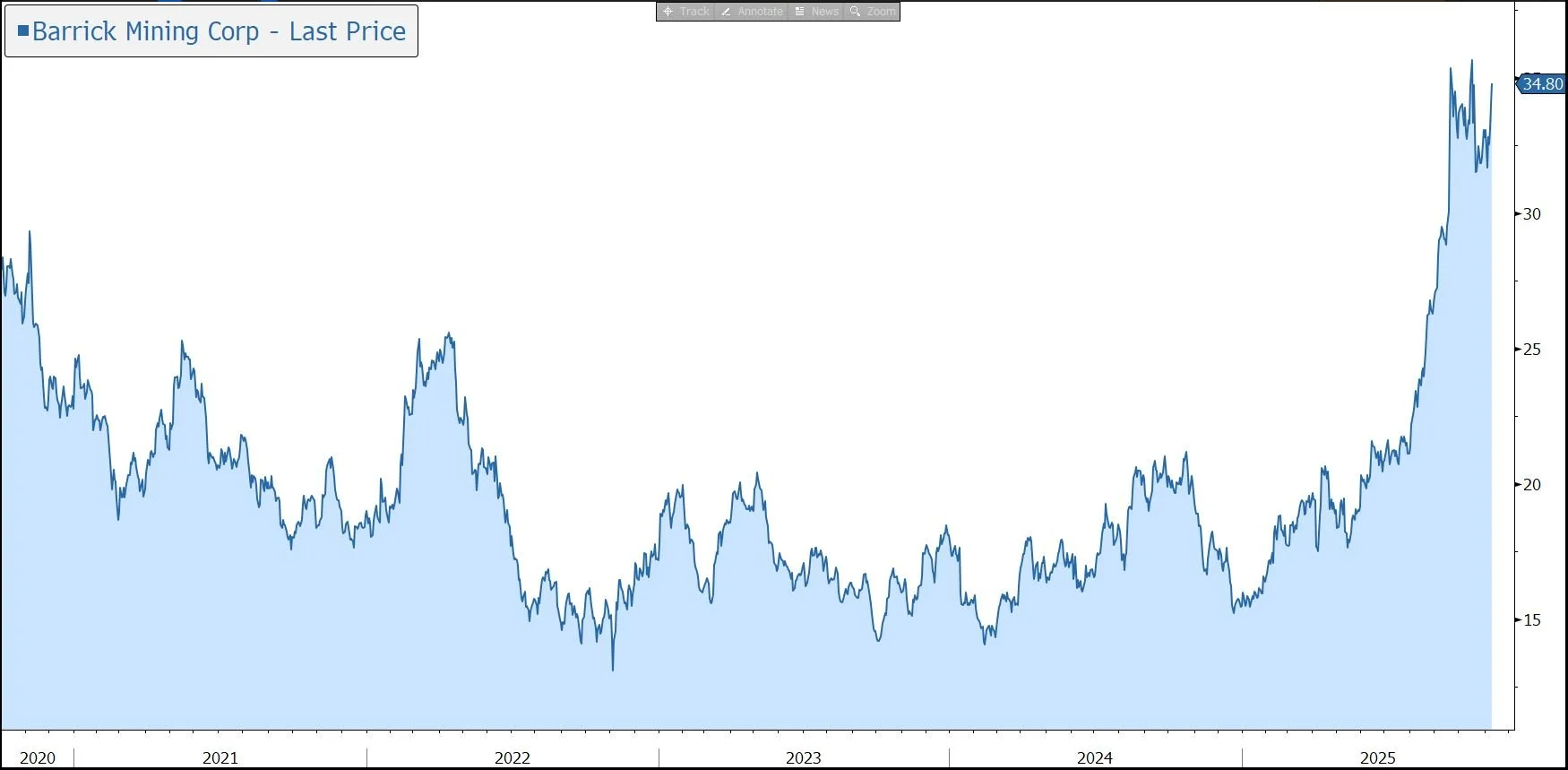

Yesterday lunchtime, Barrick Mining Corporation released Q3 results which were broadly in line with market expectations. Strong commodity prices and lower costs drove record cash flow despite lower gold production. This allowed the company to significantly increase share repurchases while also making progress on key growth projects. The company maintained its full-year production guidance, albeit tracking at the lower end of the range. The shares have been a very strong performer this year, and during yesterday’s trading session they were marked up by 5%, helped in part by the bounce in the gold price.

Barrick Mining Corp. is the world’s second largest gold producer. The company was created following the 2018 merger of Barrick Gold and Randgold Resources. In addition, in 2019, the group improved its portfolio through the formation of the Nevada Gold Mines joint venture with Newmont, providing exposure to the single largest gold-mining complex in the world.

As a result, the group operates mines and projects in 18 countries in North and South America, Africa, Papua New Guinea, and Saudi Arabia. It now owns six of the world’s Top 10 Tier One gold assets with the largest reserve base among its senior gold peers. At the end of 2024, attributable gold reserves were 89m ounces, with 10-year mine plans based on reserves and geologically understood resource extensions. The group recently made a generational gold discovery at Fourmile in Nevada. Non-core assets are being sold – in June, the group completed the $1bn disposal of its 50% interest in the Donlin Gold Project.

The interim CEO has begun an operational review from the bottom up to ensure the company is completely focused on delivering results safely and consistently going forward and will provide an update with the year-end results.

Overall, Barrick provides an attractive way to gain exposure to the gold price, albeit with the operational and political risks that come with a production company. The company is also well positioned to capitalise on global decarbonisation trends driving the long-term fundamental strength of copper with two world-class projects set to deliver into a rising price and demand market.

In the third quarter of 2025, revenue grew by 23% to $4,148m, in line with the consensus forecast, while adjusted net EPS rose by 93% to 58c, a touch above the market consensus of 57c.

Gold production was down 12% to 829k ounces, although up 4% versus the previous quarter, leaving the company on track to deliver on its full-year production guidance which has been reiterated. The gold price has rallied sharply so far this year, driven by global geopolitical and macro-economic uncertainty, exacerbated by the Trump administration, continued central bank bullion buying, and concern over fiat currency debasement. During the third quarter, Barrick realised a gold price of $3,457 per ounce, up 39% versus last year.

Barrick has the lowest total cash cost position among its senior gold peers, although in the latest quarter, all-in sustaining costs were up 5% to $1,538/ounce. That said, costs per ounce were 6% below the previous quarter and are expected to trend lower over rest of year driven by higher production.

Group copper production rose by 15% to 55k tonnes, in line with plan, with a realised price up 3% to $4.39/pound. All-in sustaining costs were down 12% to $3.14/pound.

The group generated record free cash flow of $1,479m, up 233%, and ended the quarter with a net cash position of $323m. This leaves the group with the flexibility to manage its business and take advantage of new opportunities independent of the vagaries of the capital markets. During the quarter, the company significantly advanced several key growth projects. In addition, Barrick continued to strengthen its long-term growth foundation through reserve replacement and exploration. Capital investment was up 30% to $757m, leaving the group on target for its full-year guidance of $3.1bn-$3.6bn.

In addition to a quarterly base dividend, a performance dividend is paid based on the amount of cash, net of debt, on the balance sheet at the end of each quarter. Today, the group has declared a payout of 17.5c for the quarter which includes a 5c performance dividend. Barrick is also undertaking a share buyback program in order to capture embedded value in business and growth pipeline. $1.0bn of shares have been repurchased year to date and the programme has been expanded by $500m to $1.5bn.

The company has reiterated its guidance for the full year: gold production of 3.15m-3.50m ounces (albeit tracking at the lower end of the range) with all-in sustaining costs of $1,460-$1,560 an ounce; copper production of 200ktm–230kt pounds with all-in sustaining costs of $2.80-$3.10 a pound. The group is assuming an average gold price of $2,400/oz – it is currently $4,000/oz – and discloses that a $100/oz move has a $450m impact on cash flow. The group is assuming an average copper price of $4.00/pound – it is currently $5.07/pound – and discloses that a 25c/pound move has a $120m impact on cash flow.

By the end of 2030, the group is still targetting more than 7.0m ounces of GEO, up 30% driven by the organic project pipeline and continued reserve replacement.

Source: Bloomberg