Morning Note: A round-up of financial market news.

Market News

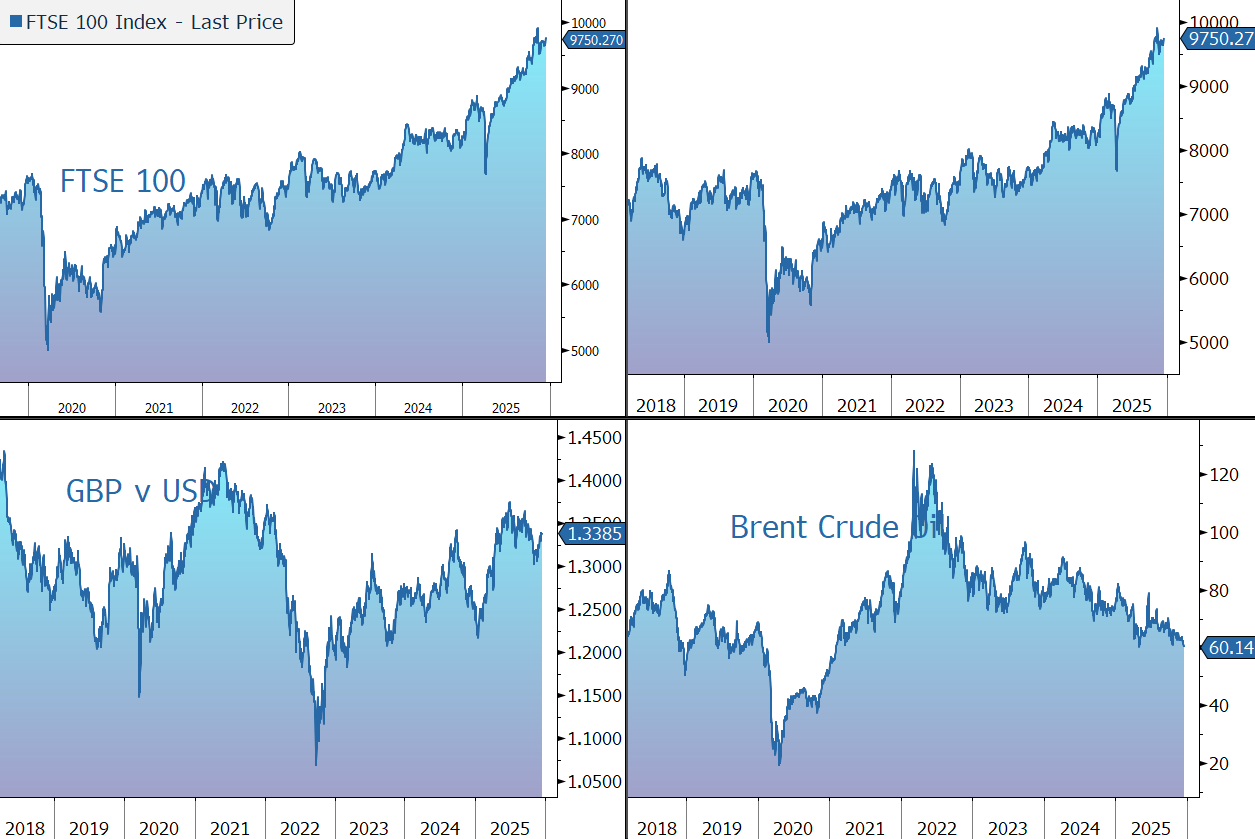

Donald Trump said the end of the war in Ukraine is “closer than ever” as negotiators offered Kyiv significant security guarantees. Territorial concessions remained an issue. Volodymyr Zelenskiy said he reached a deal with the US that the guarantees will be voted on by Congress to become legally binding. Brent Crude has fallen below $60 a barrel, the lowest since early 2021, amid renewed optimism over a Russia-Ukraine peace deal and persistent concerns about oversupply.

Sterling is little changed at $1.3370 and €1.1380 following a raft of economic data. The UK unemployment rate rose to 5.1%, while wage growth slowed to 4.6% in three months to October. A Reuters poll of economists had mostly expected regular wage growth of 4.5%. The Bank of England is watching pay as a gauge of how long Britain’s high rate of inflation is likely to last. The Bank is expected to cut interest rates to 3.75% from 4% on Thursday. Investors and analysts expect one or possibly two more cuts in 2026. The 10-year gilt currently yields 4.50%.

Gold slipped back to $4,280 an ounce as investors took profits after hitting a near two-month high in previous session, while awaiting the US non-farm payroll report later in the day for further clues on the Federal Reserve’s policy direction. The November figure may rise by a solid 130,000, Bloomberg Economics said, exceeding the 50,000 consensus. The jobless rate may climb to 4.5%. Retail sales data for October are also due. The 10-year Treasury yields 4.17%.

US equities fell last night – S&P 500 (-0.2%); Nasdaq (-0.6%) – with the decline following on in Asia this morning: Nikkei 225 (-1.6%); Hang Seng (-1.5%); Shanghai Composite (-1.1%). The FTSE 100 is currently 0.2% lower at 9,750.

Source: Bloomberg