Morning Note: Market News and update from Nvidia.

Market News

Equity markets have opened on a positive note this morning following news that the US Court of International Trade has blocked most of President Trump’s global tariffs, ruling that they were illegally imposed under an emergency law. The judgement affects levies imposed on 2 April, including a baseline 10% tariff and higher reciprocal duties on many countries. The decision permanently blocks the tariffs unless an appeals court allows Trump to reinstate them during litigation. The Justice Department has already filed a notice to appeal.

Following last night’s decline – S&P 500 (-0.6%); Nasdaq (-0.5%) – US equities are currently expected to open up 1.5% this afternoon. Nvidia rose by 5% after hours as quarterly sales beat expectations (see below). In Asia this morning, equities were also firm: Nikkei 225 (+1.9%); Hang Seng (+1.3%); Shanghai Composite (+0.7%).

Federal Reserve officials backed a patient stance on interest rates, citing rising risks from tariffs to both inflation and unemployment, minutes showed. The dollar strengthened, while gold slipped to $3,280 an ounce. 10-year Treasury yields moved back above 4.5%. Brent Crude formed to $66 a barrel.

The FTSE 100 is currently little changed at 8,730. Companies trading ex-dividend today include AB Foods (0.99%), Diploma (0.39%), Intertek (2.13%), Marks & Spencer (0.68%), National Grid (2.88%), Severn Trent (2.68%), Sage (0.61%), and Vonovia (€1.22, 4%).

BP’s Castrol lubricant unit is drawing interest from Reliance Industries, Apollo and Lone Star, according to people familiar, who said the business may fetch between $8bn and $10bn.

Sterling trades at $1.3465 and €1.1940. The UK government plans to require pension funds to invest in private markets and the domestic economy. The government will secure £27.5bn for local investment priorities from defined-benefit programs for public employees.

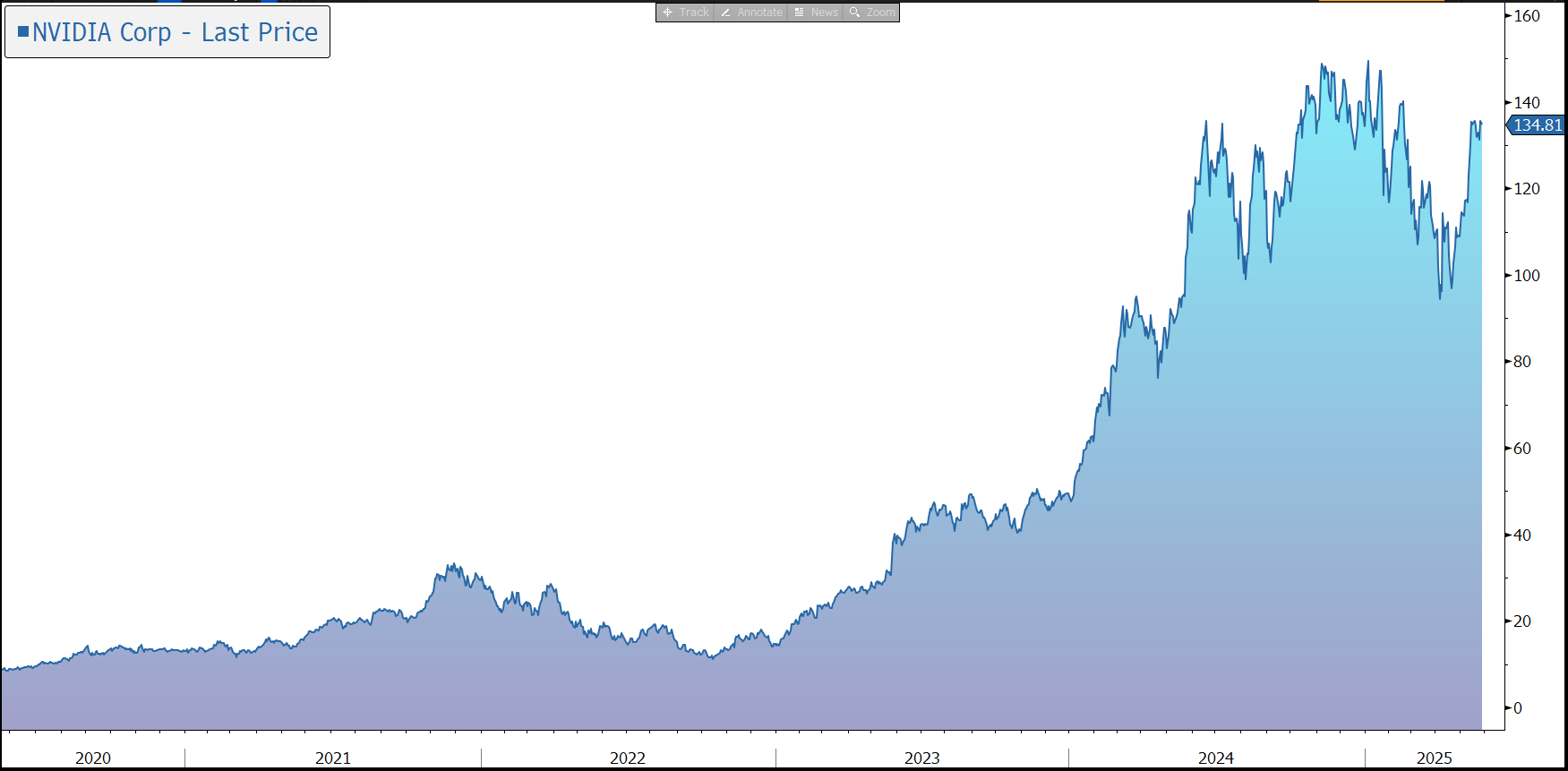

Source: Bloomberg

Company News

Last night NVIDIA released results for the three months to 27 April 2025, the first quarter of its financial year to January 2026. The figures were ahead of market expectations, although guidance for future revenue fell short of some of the most optimistic forecasts. In response, the shares rose 5% in after-hours trading.

NVIDIA is one of the world’s largest semiconductor companies, with a leading market share in Graphics Processing Units (GPUs). From its original focus on PC graphics, the company has expanded to several other large and important computationally intensive fields, leveraging its GPU architecture to create platforms for scientific computing, AI, data science, autonomous vehicles, robotics, metaverse, and 3D internet applications.

The company is benefitting as data centres make a platform shift from general computing, primarily using central processing units (CPUs), to accelerated computing, primarily using GPUs, which brings significant improvements in performance, energy efficiency, and cost.

Accelerated computing’s ability to significantly speed up machine learning and to deal with large data sets has enabled the development of generative artificial intelligence (AI), which offers human-like computing performance. This is driving significant investment in new enterprise applications, which is in turn driving new demand for accelerated computing.

In the latest quarter, Nvidia’s revenue rose by 69% to $44.1bn, exceeding the company guidance of $43bn, plus or minus 2%, and the market forecast of $43.3bn. The result was 12% higher than the previous quarter.

The vast majority (89%) of revenue is generated in the Data Centre division, with around half derived from cloud service providers and the remainder from consumer internet and enterprise companies. During the quarter, revenue increased by 73% to $39.1bn, driven by demand for the group’s accelerated computing platform used for large language models, recommendation engines, and generative and agentic AI applications.

The group’s breakthrough Blackwell NVL72 AI supercomputer, which the company describes as a ‘thinking machine’ designed for reasoning, is now in full-scale production across system makers and cloud service providers.

The smaller divisions performed as follows: Gaming (+42% to $3.8bn); Professional Visualisation (+19% to $509m); and Automotive and Robotics (+72% to $567m).

On 9 April, the company was informed by the US government that a license is required for exports of its H20 products into the China market. As a result of these new requirements, NVIDIA incurred a $4.5bn charge during the quarter associated with H20 excess inventory and purchase obligations as the demand for H20 diminished. Sales of H20 products were $4.6bn in the quarter prior to the new export licensing requirements. NVIDIA was unable to ship an additional $2.5bn of H20 revenue in the quarter.

Gross margins are high but fell to 61% in the quarter due to the H20 charge. Excluding this, the gross margin would have been 71.3%, in line with group’s guidance of 70.5%-71.5%. Operating expenses rose by 43% to $3.6bn, in line with the company guidance, primarily driven by higher compensation and benefits expenses due to employee growth and compensation increases, and compute, infrastructure and engineering development costs for new product introductions. Excluding the H20 change and related tax impact, EPS came in at 96c, just above the market forecast of 93c.

The business is very cash generative, with free cash flow up from $14.9bn to $26.1bn in the three months to 27 April. The company’s balance sheet is very strong, with net cash of $44bn at the end of the quarter. The cash is being used, in part, for shareholder returns, including $14.1bn in share repurchases. The company also pays a dividend, with a payout of $0.01 declared for this quarter.

For the current quarter, the company is guiding to revenue of $45bn, plus or minus 2% and a gross margin of 72.0%, plus or minus 50 basis points. Despite an expectation of continued strong growth, the guidance fell short of market forecasts ($46bn) as the company expects a hit to sales from tighter US curbs on exports of its AI chips to key semiconductor market China. The company is continuing to work toward achieving gross margins in the mid-70% range late this year.

Source: Bloomberg